The Africa Fintech Summit 2023

Beyond Banking: Digital Transformation in the Financial Services Industry

This is an exciting time for Fintech in Africa, as we are witnessing a range of innovations that have the potential to improve lives and drive economic growth. Now on its 8th year running, the dx5 Africa Fintech Summit will bring together leaders from across the continent who are at the forefront of this sector to discuss best practices, trends, solutions and challenges facing African financial services sector today.

Speaker List

Technology within the financial services industry (FSI) is transforming payments, finance, wealth management and insurance industries. Financial institutions are improving efficiency and effectiveness in their service delivery through the adoption of a multitude of technologies including Artificial Intelligence (AI), Cloud Computing, Robotic Process Automation (RPA), Blockchain, Big Data and Analytics among other technologies all this wrapped in a secure infrastructure.

Topics to be covered

This year's Fintech summit will cover the following areas

Artificial Intelligence (AI)

Edge Computing

DevOps

Robotic Process Automation (RPA)

Cybersecurity

NeoBanking

Payments and Remittances

Lending and Microlending

Digital Banking

Target Audience

The annual Fintech Summit targets a wide range of people and institutions in the Fintech space and offers an opportunity to meet key market players.

Heads of Compliance

Heads of Risk

Chief Information Officers

Chief Digital Offiers

Chief Financial Officers

Heads of Investment

Investment Bankers

Heads of Fintech

IT Infrastructure Managers

Chief Information Security Officers

Governance, Risk and Compliance Managers

Payment Systems Managers

Digital Banking Managers

Delivery Channel Managers

Chief Risk Officers

Speakers

Harry Hare

Co-Founder and Chairman, dx5

Moses Okundi

CIO, Absa Bank Kenya

Dennis Volemi

Chief Information and Digital Officer, Diamond Trust Bank

Ben Roberts

Group Chief and Technology Officer, Liquid Intelligent Technologies

Vimal Shah

Co-Founder and Chairman, Bidco Africa

Valentine Wambui

Manager - Fintech and Startups, KCB Bank Group

Sandeep Chagger

Group COO, Peach Payments

Seun Owoeye

Senior Vice President, Domestic Payments Network (Europe, the Middle East and Africa), Citi

Dr James Wanjagi

Acting CEO, Kenya Institute of Bankers

Carolyne Guya

Proprietor and Technology Lawyer, Guya and Associate Advocates

Elias Omondi

Principal, Innovation for Resilience, FSD Africa

Mbugua Njihia

COO, Safiri Express

James Muigai

Director, Information Technology and Operations, Sidian Bank

Robert Ochieng'

CEO and Co-Founder, Abojani

Dr Bright Gameli Mawudor

Cyber Security Lead, Mara

Annstela Mumbi

General Manager, Tala

Steve Njenga

Group CIO - Payments, Equity Group Holdings

Jaine Mwai

Head, Country Technology Management - Kenya and East Africa, Standard Chartered Bank

George Murage

CTO, Integrated Payment Service Limited (IPSL)

Timothy Munyao

AWS Solutions Architect, Eleven Degrees Consulting Ltd

Imran Sumra

Founder and CEO, FinSense Africa

Catherine Maina

Senior Cloud Solution Manager, Huawei

Francis Mwangi Wokabi

Group Head, IT Security and Infrastructure, Platcorp Group

Bernard Wanjau

Data Centre Solutions Specialist - South East Africa, Dell Technologies

Topyster Muga

Founder and CEO, Prosper Mentor

Timothy Oriedo

Founder and CEO, Predictive Analytics Lab

Simion Rutto

Group Head of Forensic and Security Services, Britam

Samson Ogada

Cyber Security Specialist, Cloudlogic Ltd

Albert Ndeto Mulei

Head Commercialisation and Growth - Digital Financial Services, KCB Bank Group

Judy Ngure

Cyber and Information Security Consultant | Advisory Board Member, Cybersafe Foundation

Osama AlZoubi

CTO - Middle East and Africa, Cisco

Martin Kamethu

Technical Solutions Lead, Serianu Ltd

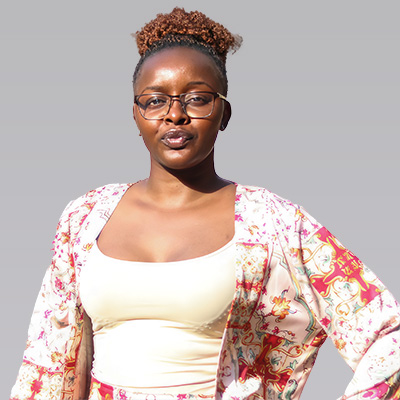

Laura Tich

Founder, ShaHacks KE

Kevin Mutiso

Co-Founder and CEO, OYE

Andrew Munene

Manager- IoT/M2M Sales and Global Partnerships, Bayobab (formerly MTN GlobalConnect)

Christopher Akolo

Regional Business Development Director, JuicyScore

Hartnell Ndungi

Chief Data Officer, Absa Bank Kenya

Michael Michie

Artificial Intelligence Consultant

Mark Wang

Director, Cloud Solution Architect, Huawei

Sharon Kinyanjui

Principal Consultant, Diaspora Bridges Advisory

George Wakaria

Director, Treasury and Trade Solutions Head - Kenya and East Africa, Citibank

Joel Onditi

Group CEO and President, Pathways International

Patrick Odhiambo Ochieng

Customer Success - Senior Technical Account Manager, VMware

Jason Eisen

Founder and CEO, UTU technologies

Lucy Kimani

Technical Lead and Quality Assurance, SasaPayKE

Janet Dali

Head, Partnerships, Ecosystems and Strategic Alliances, Diamond Trust Bank

Olivia Etyang

Head of Innovation Studio, SSA, Visa

Leonard Mabele

Lead - Research and Innovation, African Advanced Level Telecommunications Institute (AFRALTI)

Hussein Popat

Business Manager – Cloud and Digital, Computech Ltd

Faisal Omar

Chief Product Officer, Pesalink

Kelvin Mbogo

Cyber Security Specialist , Data Security and Privacy, KCB Bank Group

Ahmed Abdulwahab

Founder, CEO and Chief Innovation Officer, Next Arabia

Agenda

-

CEO Breakfast

June 22, 2023

07:00 AM - 09:15AM

-

Day 01

June 22, 2023

09:15 AM - 06:00 PM

-

Day 02

June 23, 2023

09:15 AM - 05:00 PM

Welcome and Introductions

Harry Hare

Co-Founder and Chairman, dx5

Fireside Chat

Ahmed Abdulwahab

Founder, CEO and Chief Innovation Officer, Next Arabia

Vimal Shah

Co-Founder and Chairman, Bidco Africa

Lightning Talks: Tech Trends in BFSI

Lightning talks on Future of Payments, AI and Cyber Security

Steve Njenga

Group CIO - Payments, Equity Group Holdings

Jaine Mwai

Head, Country Technology Management - Kenya and East Africa, Standard Chartered Bank

Martin Kamethu

Technical Solutions Lead, Serianu Ltd

CEO Insights: Strategies for Successful Digital Transformation

Mark Wang

Director, Cloud Solution Architect, Huawei

Roundtable Discussion: Addressing Key Technology Challenges in BFSI

Dr James Wanjagi

Acting CEO, Kenya Institute of Bankers

Harry Hare

Co-Founder and Chairman, dx5

Wrap-up and Actionable Takeaways

Ahmed Abdulwahab

Founder, CEO and Chief Innovation Officer, Next Arabia

Opening Remarks

Harry Hare

Co-Founder and Chairman, dx5

Banking in the Cloud: How Digital Transformation is Changing the Game

Catherine Maina

Senior Cloud Solution Manager, Huawei

Big Data, Big Insights: How Analytics is Revolutionizing Digital Banking

Hartnell Ndungi

Chief Data Officer, Absa Bank Kenya

Coffee Break

Open Banking: Is the Future API-Driven?

Are APIs the key to unlocking the Future of Banking? This panel discussion will delve into the exciting potential of open banking, which allows third-party providers to access financial information from banks through APIs. We'll examine how this API-driven model can help banks and other financial services innovate and provide more customer-centric services, and explore the opportunities and challenges of this new frontier in banking. With the potential to create new business models and revenue streams, we'll discuss whether APIs are the key to unlocking the future of banking as we know it.

Imran Sumra

Founder and CEO, FinSense Africa

Dennis Volemi

Chief Information and Digital Officer, Diamond Trust Bank

Valentine Wambui

Manager - Fintech and Startups, KCB Bank Group

Lucy Kimani

Technical Lead and Quality Assurance, SasaPayKE

Faisal Omar

Chief Product Officer, Pesalink

Blockchain Brilliance: Smart Contracts and Distributed Ledgers are the Future of Banking

Dr Bright Gameli Mawudor

Cyber Security Lead, Mara

AI-Powered Lending: The Smart Way to Access Credit in the Digital Age

Kevin Mutiso

Co-Founder and CEO, OYE

Collaboration is the New Competition: Strategic Partnerships in Digital Banking

Collaboration over competition! This panel will discuss the shift towards strategic partnerships in the digital banking industry, where banks and fintech companies work together to provide innovative and customer-centric solutions. Exploring how these collaborations are changing the landscape of banking and discuss the benefits and challenges of this new approach to competition. By putting aside traditional rivalries and joining forces, we'll see how strategic partnerships can lead to a more dynamic and responsive banking ecosystem that benefits customers and stakeholders alike.

Carolyne Guya

Proprietor and Technology Lawyer, Guya and Associate Advocates

Elias Omondi

Principal, Innovation for Resilience, FSD Africa

George Wakaria

Director, Treasury and Trade Solutions Head - Kenya and East Africa, Citibank

Timothy Munyao

AWS Solutions Architect, Eleven Degrees Consulting Ltd

Osama AlZoubi

CTO - Middle East and Africa, Cisco

Banking as a Service: Opportunity for African Banks?

Janet Dali

Head, Partnerships, Ecosystems and Strategic Alliances, Diamond Trust Bank

Lunch Break

Hybrid Cloud: The Best of Both Worlds for Digital Banking

Patrick Odhiambo Ochieng

Customer Success - Senior Technical Account Manager, VMware

The Internet of Banking: How IoT is Transforming the Financial Sector

Leonard Mabele

Lead - Research and Innovation, African Advanced Level Telecommunications Institute (AFRALTI)

Edge Computing: Bringing Banking to the Edge of the Network

Bernard Wanjau

Data Centre Solutions Specialist - South East Africa, Dell Technologies

Are 5G and IoT in BFSI a Match Made in Heaven?

Is 5G and IoT the perfect pair for banking and financial services?" This panel will explore the potential of the marriage between 5G and IoT technologies in the banking and financial services industry. Examine the benefits of this powerful duo, including faster and more secure transactions, real-time data analytics, and personalized customer experiences. We'll also discuss the challenges and considerations involved in implementing these emerging technologies, such as data privacy and security concerns.

Andrew Munene

Manager- IoT/M2M Sales and Global Partnerships, Bayobab (formerly MTN GlobalConnect)

Ben Roberts

Group Chief and Technology Officer, Liquid Intelligent Technologies

Moses Okundi

CIO, Absa Bank Kenya

Albert Ndeto Mulei

Head Commercialisation and Growth - Digital Financial Services, KCB Bank Group

Jaine Mwai

Head, Country Technology Management - Kenya and East Africa, Standard Chartered Bank

Future of Finance: Neobanks and the Evolution of Digital Credit

Annstela Mumbi

General Manager, Tala

The Future of Payments: Innovations and Trends in Digital Banking

Steve Njenga

Group CIO - Payments, Equity Group Holdings

Wearable Banking: Is This the Next Wave of Mobile Banking Innovation

Is wearable Banking the future of mobile banking? This panel explores the potential of wearable devices as the next wave of mobile banking innovation. Examining how wearable banking technology can provide customers with easy access to banking services on-the-go, without the need for a smartphone or computer. The panel will also discuss the opportunities and challenges of implementing wearable banking technology, such as ensuring security and privacy of personal financial information.

Mbugua Njihia

COO, Safiri Express

James Muigai

Director, Information Technology and Operations, Sidian Bank

Olivia Etyang

Head of Innovation Studio, SSA, Visa

Networking Session

Opening Remarks

Harry Hare

Co-Founder and Chairman, dx5

The AI Advantage: How AI is Empowering Banks to Deliver Better Service

Joel Onditi

Group CEO and President, Pathways International

Securing the Digital Bank

Martin Kamethu

Technical Solutions Lead, Serianu Ltd

Coffee Break

Fragmentation and Interoperability: Peer-To-Peer as the Future of Payments

A Glimpse into the Future of Money. This panel will explore the future of money through the lens of digital currency and central bank digital currency (CBDC). The panelists will examine how digital currencies are changing the landscape of traditional banking and financial services and discuss the potential benefits and challenges of a CBDC system. From increased transaction speed and convenience to potential risks such as cyberattacks and financial instability, we'll explore the implications of this emerging technology for the future of money.

Topyster Muga

Founder and CEO, Prosper Mentor

Seun Owoeye

Senior Vice President, Domestic Payments Network (Europe, the Middle East and Africa), Citi

Sharon Kinyanjui

Principal Consultant, Diaspora Bridges Advisory

George Murage

CTO, Integrated Payment Service Limited (IPSL)

Sandeep Chagger

Group COO, Peach Payments

Decentralized Finance: The New Frontier of Banking and Investment

Jason Eisen

Founder and CEO, UTU technologies

Financial Services in the Age of AI: A Crystal Ball

Michael Michie

Artificial Intelligence Consultant

Are AI and ML the best Approach to Fraud Detection in FSIs?

Fraud, especially its dynamic nature, is a major area of concern requiring significant time and resources to isolate from an enormous volume of transaction data generated by financial institutions. As online transactions increase so is the increase in velocity of fraudulent transactions. Can artificial intelligence (AI) and machine learning (ML) help FSIs to deal with this enormous challenge? Increase the speed of accurate detection and even predict future fraudulent transactions?

Carol Odero

Head of Content, dx5

Michael Michie

Artificial Intelligence Consultant

Simion Rutto

Group Head of Forensic and Security Services, Britam

Christopher Akolo

Regional Business Development Director, JuicyScore

Joel Onditi

Group CEO and President, Pathways International

Data Privacy: Ensuring Compliance With Data Protection Regulations

Timothy Oriedo

Founder and CEO, Predictive Analytics Lab

Lunch Break

Zero Trust and DevSecOps: Integrating Security into the Development Process

Judy Ngure

Cyber and Information Security Consultant | Advisory Board Member, Cybersafe Foundation

Implementing Zero Trust: Best Practices and Lessons Learned

Unlocking the secrets to a secure digital world! This panel discussion will explore the world of Zero Trust Security and discover the best practices and lessons learned from industry leaders. From identity and access management to network segmentation, we'll delve into the key components of a Zero Trust Architecture and explore how you can implement this game-changing approach to cybersecurity in your organization.

Francis Mwangi Wokabi

Group Head, IT Security and Infrastructure, Platcorp Group

Laura Tich

Founder, ShaHacks KE

Judy Ngure

Cyber and Information Security Consultant | Advisory Board Member, Cybersafe Foundation

Samson Ogada

Cyber Security Specialist, Cloudlogic Ltd