advertisement

DTB pre-tax profit rise by 18% attributed in part to leveraging of technology

Diamond Trust Bank has credited leveraging of technology such as; mobile banking, internet banking and card services, for their 2014…

Diamond Trust Bank has credited leveraging of technology such as; mobile banking, internet banking and card services, for their 2014 group pre-tax profit rising by a 18%, to Kshs 8.5 billion, up from Kshs 7.2 billion in 2013.

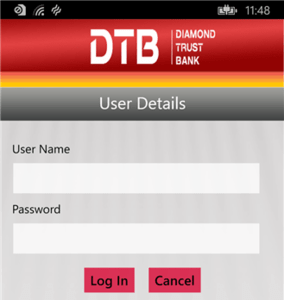

Announcing the group’s annual results, DTB’s Managing Director and Group CEO, Mrs. Nasim Devji said that DTB’s underlying growth benefitted from a continuously expanding customer base serviced through branches as well as, technology- anchored, alternate delivery channels including mobile banking, internet banking and card services. The group results have also benefitted from the continuing growth of and share of results from, DTB’s subsidiaries in Tanzania, Uganda and Burundi.

“2014 has been yet another exceptional year for DTB, with notable growth achieved across all key balance sheet parameters, as well as earnings, on the back of a growing market share of assets and profitability across the East African region.” Mrs. Devji added

advertisement

The group asset base went up by 27% to stand at Kshs 212 billion up from Kshs 167 billion in 2013. DTB group’s customer deposit base rose by 25%, from Kshs 129 billion in 2013 to Kshs 161 billion over the corresponding period ending December 2014. The loan book for the group grew by a significant 24%, to stand at Kshs 138 billion; the total group operating income rose by 15% to Kshs 16.6 billion up from Kshs 14.4 billion realized over the same period in the previous year.

Following the announcement of the results, the bank’s Board of Directors has recommended a dividend rate of 60%, equating to Kshs 2.40 per share, compared to Kshs 2.10 (52.5%) paid last year. This translates into a 26% increase, year on year, in the amount of dividend payout as the proposed dividends will also be paid on the additional shares allotted to shareholders in September last year, following a rights issue.

”The capital raised through the rights issue will be used to fund the bank’s strategic expansion plan in East Africa as well as in new markets DTB enters into in the future”, said Mr. Abdul Samji, DTB Group Chairman.

advertisement

Mr. Samji said that DTB would continue to focus on its branch expansion programme, adding that group’s branch network in East Africa stood at 110 presently; in Kenya, the bank operates 51 branches whilst in Uganda and Tanzania, DTB has 33 and 22 branches respectively; DTB Kenya’s subsidiary in Burundi operates four branches. In Kenya, the bank plans to leverage its growing suite of alternative delivery channels to increase its outreach to customers.

DTB is an affiliate of the Aga Khan Fund for Economic Development (AKFED), the economic development arm of the Aga Khan Development Network. Amongst the bank’s key shareholders are Habib Bank Limited and Jubilee Insurance, both affiliates of AKFED.