advertisement

DTB, Mastercard’s new partnership seeks to leverage on Kenya’s love of digital payments

The launch of this solution comes after a recent sector report by the CA which revealed that Payments for goods…

The launch of this solution comes after a recent sector report by the CA which revealed that Payments for goods and service through the mobile money transfer platforms hit Sh627.4 billion in the first three months of the year, demonstrating a higher appetite for the service as an alternative to hard cash and card payment.

Chris Bwakira, Vice President and Area Business Head, East Africa at Mastercard said, “Delivering efficient, secure and cost effective acceptance solutions to Kenyan merchants is an essential step to providing the level of support required to grow and develop businesses. According to Kenya’s Micro and Small Enterprises Authority, almost 80 percent of the country’s critical jobs are created by these small enterprises, therefore it is critical that we introduce relevant solutions that addresses specific challenges.”

According to the Communications Authority of Kenya sector statistics report for three months to March, the volume of transactions on this platform were recorded at Sh471.1 million with Sh1.1 trillion moved during the period.

advertisement

Mobile commerce recorded a total of 290.5 million transactions. The number of mobile money subscriptions stood at 27.5 million subscriptions whereas the number of active mobile money transfer agents was registered at 174,018 up from 161,583 in the previous quarter.

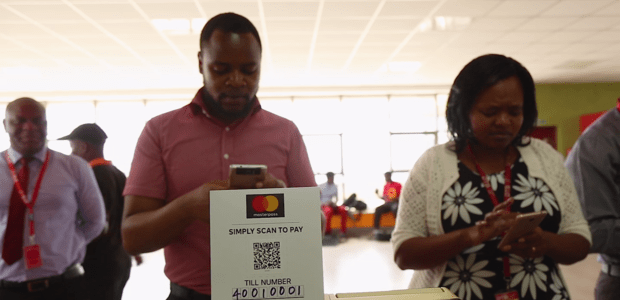

Masterpass QR app in Kenya

The launch of the solution comes after merchant service provider, Kopo Kopo, announced their partnership with Mastercard in March 2017, to roll out Masterpass QR across eleven markets in Sub-Saharan Africa, impacting over 250,000 micro, small and medium enterprises (MSMEs) over the next five years. Kopo Kopo will be working with DTB to ensure the solution reaches their full network, meeting the needs of merchants working across various sectors in the country.

advertisement

Masterpass QR is a mobile solution that provides a fast, convenient and secure payment solution for consumers and a reliable and instant acceptance tool for merchants. Cash is no longer the only form of payment small and micro merchants need to accept from their customers, Masterpass QR enables them to accept digital payments anywhere, anytime.

With the DTB mobile banking platform, users will be able to safely pay for in-store purchases by scanning a Quick Response (QR) code displayed at checkout on their smartphones, or by entering a merchant identifier into their feature phones. Consumers don’t need to carry cash or their physical bank cards – rather they can pay immediately using the DTB Masterpass QR app on their mobile device anywhere that Masterpass QR is accepted.

Currently Masterpass QR is being introduced at key Kopo Kopo merchants in Nairobi, but there are plans to ensure the solution is accessible across the country. Additionally, the interoperable solution can be used in markets outside of Kenya, and Mastercard has started to introduce the solution in multiple markets across the continent.

advertisement

“The mobile solution will not only eliminate the merchants’ reliance on costly point of sale devices, it will also remove the dangers and logistical issues of handling cash on daily sales. Kenyan merchants who previously didn’t have access to electronic payment tools can now be financially included ensuring they are able to track and monitor the businesses cash flow immediately,” says Nasim Devji, Group CEO and Managing Director at DTB.

Devji adds that DTB customers will be able to use their mobile banking app to access Masterpass QR, and conduct their day-to-day banking needs directly on their device.