advertisement

Pioneering The Future Of Banking In Africa

The banking sector in Africa is at an important juncture in its transformation journey. The industry has achieved significant milestones. At the same time, challenges remain around navigating increased competition, evolving regulations, and the need to expand finance access and inclusion. To thrive amidst these complexities, banks must embrace a digital-first strategy across their organisations. This approach opens the door to greater financial inclusion as well as faster and more efficient customer onboarding and originations that can serve as catalysts for differentiation.

Seamless customer experiences, remote account openings, and innovative lending products can all accelerate growth. And, a rapidly unfolding landscape of digital payments—with the ascent of networks, like the Pan-African Payment and Settlement System (PAPSS) that promises interoperability across the continent—is key to expanding financial and economic inclusion for unbanked and underbanked individuals.

As pioneers lead the industry forward, a collaborative approach toward addressing pain points can unlock mutual value and shape a more robust financial ecosystem. Though the path has obstacles, greater financial access and efficiency are both within reach, and Oracle Financial Services is helping leaders to set a path for a new era of banking innovation across Africa.

advertisement

“Banks of the future will be characterised by digital innovation, customer centricity, ecosystem integration, sustainability, regulatory compliance, and resilience. Embracing these principles will enable banks to adapt to the digital age, drive sustainable growth, and position themselves as trusted partners in the customer’s financial journey, stated Habil Olaka, CEO of the Kenya Bankers Association.

An Evolving Landscape

Across the continent, several common trends underscore both the opportunities and challenges facing African financial institutions.

advertisement

Economic Opportunity On The Horizon

Significant economic development on the horizon across the continent is expected to lead to new growth opportunities for banks and other financial enterprises. Recent McKinsey reports indicate that Africa already hosts over 400 companies with annual revenues exceeding $1 billion, and the African Continental Free Trade Area, which fosters connections among numerous countries, will likely fuel additional growth. As cross-border economic opportunities continue to grow, the landscape of digital payments is evolving rapidly. The ascent of payment networks is becoming increasingly critical, as are corporate customers who require advanced control over their working capital.

High operational costs and growing competition pose a threat to profitability.

advertisement

African banks face high operational costs, with an average cost-to-asset ratio of 4 to 5 per cent—nearly double the global average continues the report. Since 2016, profitability in Africa’s five major banking markets (Egypt, Kenya, Morocco, Nigeria, and South Africa) has steadily declined, dropping by an average of two percentage points over six years. In addition, the rise of digital-first banks that rely entirely on mobile apps and Internet banking platforms is creating increased competition and eroding the position of traditional banks.

“The interaction of traditional banking and innovation offers numerous opportunities for banks. We have observed that banks performing well in Africa have embraced innovation,” said Sunay Mruthyunjay, Senior Director of Product Strategy at Oracle Financial Services. In addition, as digital markets mature in Africa, the performance gap widens between leading and lagging banks, with digital frontrunners achieving four times better results than their counterparts, according to McKinsey. As a result, digital transformation and innovation emerge as paramount priorities for African banks.

Smartphones Create New Opportunities For Financial Inclusion

Digital transformation can play an important role in helping Africa reach its financial inclusion objectives. In sub-Saharan Africa, African banking: The productivity opportunity | McKinsey. Digital finance, via mobile phones, can provide individuals with access to convenient tools to support economic activities, including payments from governments or businesses to people. The Communications Authority of Kenya reports that there are more than 30 million Kenyans using smartphones. This has already opened the door for millions of Africans to gain access to financial services.

And, the opportunities for banks to introduce digital products are far from exhausted as nearly half of the population remains unbanked. 48 per cent of Africa’s population uses banking services, meaning half the population is unbanked and cash remains the dominant form of payment. “Digital transformation will help banks enhance efficiency, contend with increased competition, adapt to evolving regulations, expedite digitalization, and seize growth opportunities,” says David Bunei, Kenya Country Leader and Sales Director Cloud Systems – West and East Africa at Oracle.

Cloud Accelerates Innovation

Increasingly the adoption of true Software as a Service (SaaS) solutions is helping to power digital-first banking and support new business models that are agile, scalable and open to other service providers and their clients. They provide a highly relevant, digital-first, customer-centric proposition through cloud platforms.

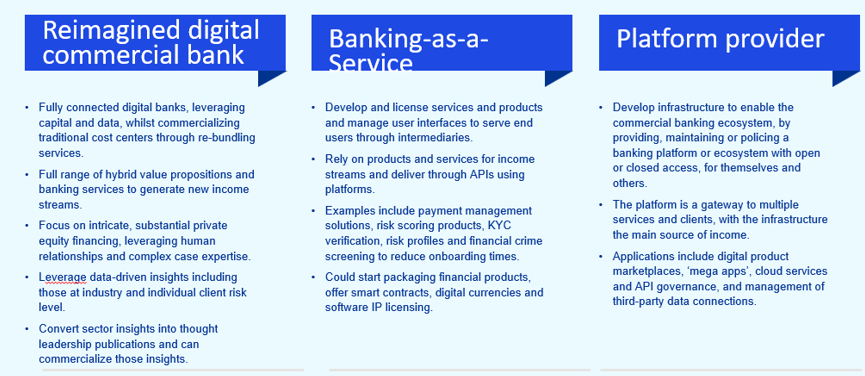

These models include:

Source: KPMG

Retail Banking Perspective: Delivering Fast, Innovative, Frictionless Digital Originations

There has been a massive shift in customer experience expectations as consumers enjoy, embrace, and now expect the ability to connect and transact immediately, anytime from anywhere. If an organization cannot deliver on this requirement, customers are likely to abandon a journey or relationship. These same expectations apply to their financial partners, where significant friction persists, including in onboarding and origination processes. Today, 60 per cent of retail customers prefer digital account opening—which is a win for customers who experience faster onboarding and banks that enjoy lower costs—averaging $5 per digital account opening.

The African banking industry is in the midst of an onboarding transformation. The use of facial recognition technologies, camera use, file upload, and location tracking as well as electronic know your customers (eKYC) processes in some countries have helped to remove friction from customer-facing onboarding processes. On the backend, however, complexity and manual processes remain and prevent a seamless customer journey.

Ongoing challenges include:

Poor Customer Experiences

Onboarding journeys are often not consistent, intuitive, or mobile-first. They often involve heavy form-filling and data capture, which can be burdensome and frustrating for customers. Globally, poor customer experience with a lot of heavy form filling and data capture can be annoying for the customers. Globally, many applications can take more than 20 minutes to complete due to extensive and cumbersome forms and data capture.

Limited KYC Capabilities

Banks are using legacy, closed systems with restricted access to KYC databases and limited ID verification capabilities. These challenges impede the ability to complete KYC processes digitally.

Regulations

Regulatory constraints in some countries continue to pose a significant challenge as they prohibit the use of digital signatures for customer onboarding processes. This creates further hurdles and complexity for onboarding.

Fractured Communication

Many times, when a potential customer faces issuers during digital onboarding, there is no live assistance available, and the bank has no way of reaching the potential customer. As a result, they abandon the journey.

Longer Time To “Yes”

In a world where customers expect instant answers, many banks struggle to provide a quick time to a conditional “yes,” let alone final approval subject to documentation. This is especially true when it comes to loans. While some banks have gone a long way in redefining customer journeys from the customer-facing side, many back-end processes still require manual intervention. As a result, the process slows and the customer has no visibility into the status of their application, both of which lead to attrition.

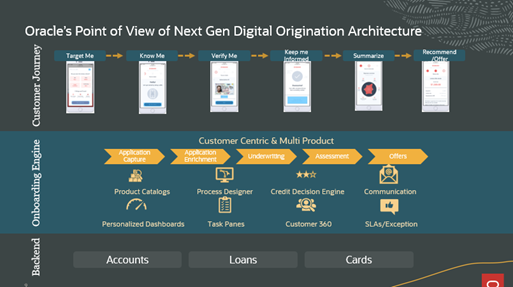

Looking Inside

Oracle believes it’s time for banks to look at their origination processes holistically from front to back. To achieve this goal, banks require an onboarding engine that is agile, easy to configure and deploy, to provide a great degree of automation. It should include a process designer that is flexible and easy to use. Automated credit scoring and decisions are also key for smooth frictionless journeys. Further, this layer should be able to scale on demand and integrate into multiple backends that hold various customer accounts.

Oracle’s architecture and applications are delivering next-generation digital capabilities that include:

- Smart and easy digital onboarding with complete transparency to the customer

- Digital-first product catalogues and configurable onboarding policies that help to expand access to underserved populations that lack access to branches but have mobile connectivity

- Automated rules-based and artificial intelligence (AI)-supported decision that enables faster onboarding and time-to-yes

- Drag and drop process design capabilities for faster implementation

- Pre-built process flows, including multi-product onboarding

- Cloud-native solutions that accelerate innovation and scale on demand

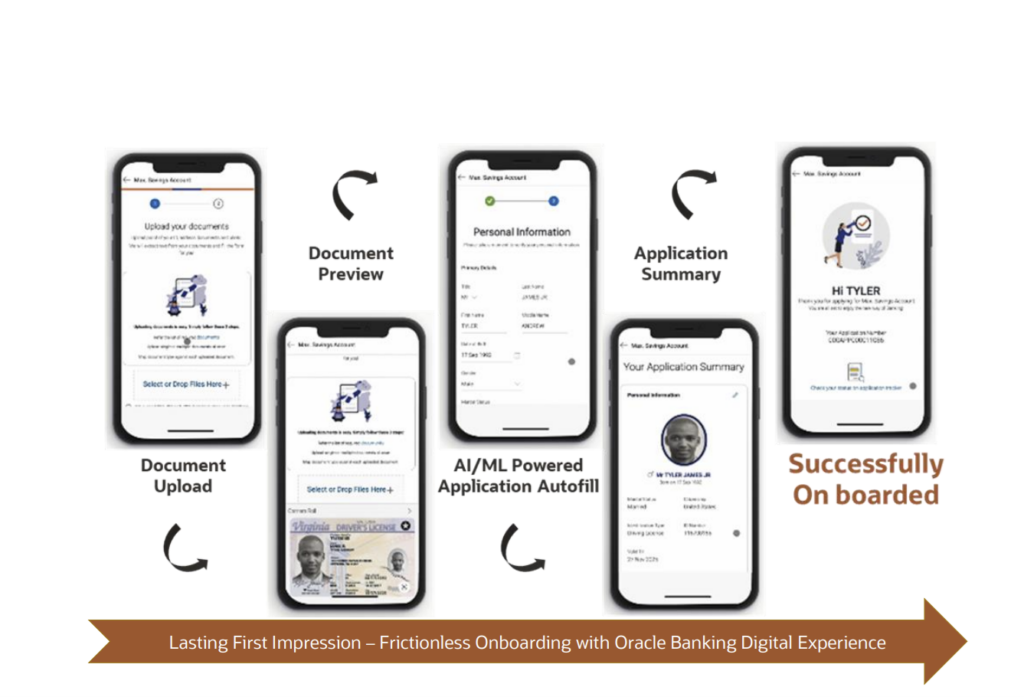

Frictionless Onboarding With AI

Oracle banking solutions deliver AI-enabled digital onboarding.

- Enable easy and guided processes for uploading documents, signing digitally and tracking the application approval in real-time

- Support completing KYC processes through video with a banker or a self-KYC, in which the customer uploads documents for verification

- Provide interaction and information via voice chat and chatbots

- Leverage Optical Character Recognition and Natural Language Processing to extract data from the identification documents provided by the customer, Google Maps integration for address mapping, and QR code scans for increased security

- Deliver next-best product recommendations as well as product bundling via advanced algorithms

Corporate Banking Perspective: Fast-Forward—Accelerating Digitisation Of Corporate And Transaction Banking

Historically, corporate banking has been largely built on personal relationships—many of which are cultivated over the years via in-person meetings and interactions. As such, this sector has been slower to embrace digital innovation than retail banking. Banks can no longer afford to delay as corporate clients expect increasingly personalized service and offers. They are also looking for value-added services, such as easy integration with corporate enterprise resource planning (ERP) and treasury systems, along with real-time information and self-service functions that can improve efficiency and financial transparency.

From a relationship perspective, corporate customers want:

- Banks to understand their context, so they are not asked for the same information repeatedly

- Contextual offers based on their unique business needs and cycles

- A value-add advisory relationship versus simply selling and providing products

In addition, as they seek to address some of their most compelling business challenges, corporate banking clients are looking for digital solutions that enable:

- Real-time visibility to cash and liquidity management so they can manage their working capital more effectively

- Faster onboarding and lending decisions so they can pursue opportunities as they emerge

- A unified, 360-degree view of all trade transactions to improve transparency and reduce complexity

- Unified supply chain finance and factoring that spans the entire lifecycle

Digital Transformation Comes To Transaction Banking

One specific area of corporate banking services that is primed for digital transformation is transaction banking as customers seek to:

- Achieve better control over working capital with virtual account management

- Gain preferred and contextual pricing based on volume

- Process payments in real-time, anywhere, and at scale to enable real-time reconciliation of case and liquidity positions

- Simplify treasury management and improve visibility and control

Embedded banking is increasingly the future of transaction banking and is changing how businesses experience banking services. Ecosystem partnerships deliver financial products directly via customer platforms, greatly enhancing customer experience and value derived to clients. Legacy systems, however, are holding back many banks from achieving the scale and responsiveness that corporate customers expect today and participating in the opportunities of embedded transaction banking. There is no shortage of challenges or implications related to these legacy infrastructures.

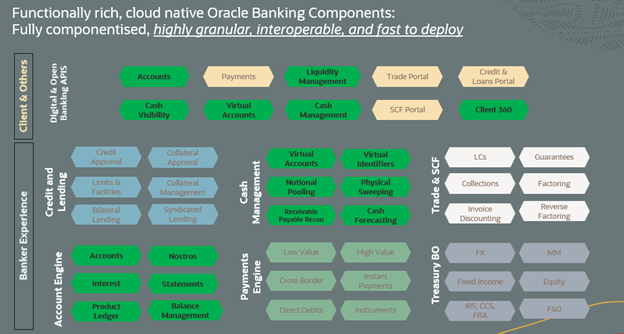

Redefining Transaction Banking

Oracle is addressing these issues through a highly componentised approach. Starting from the core, we have developed a light corporate banking application, with baked-in corporate demand deposit account (DDA) capabilities. It is designed as a headless (without an integral channel or UI layer) application with APIs and a native user interface, as well as persona-centric workflows. The solution is fully extensible and highly scalable for high-volume real-time processing, deployed in a SaaS environment.

On top of this core platform sits a complete range of pre-integrated, yet separately consumable product solutions including trade finance, supply chain finance, liquidity management, virtual account management, payments, lending and treasury. The solutions also include client- and banker-centric front ends, and full Open API externalisation into fintech and ERP applications—all of which are fully configurable.

This approach allows corporate banks to accelerate their time to market, scaling their business without an inherent lock-in to their retail banking business products and selecting products and applications in a manner which matches their go-to-market strategy.

Generative AI-powered Corporate Banking

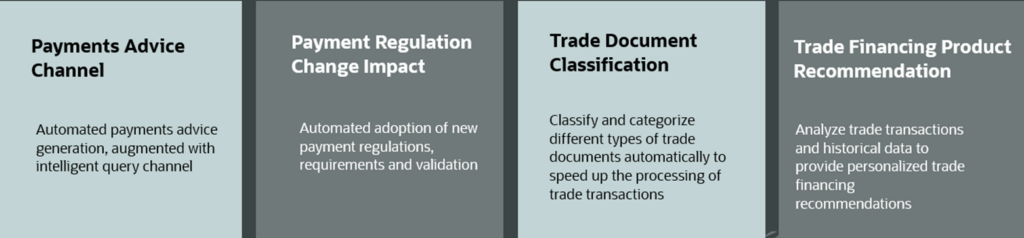

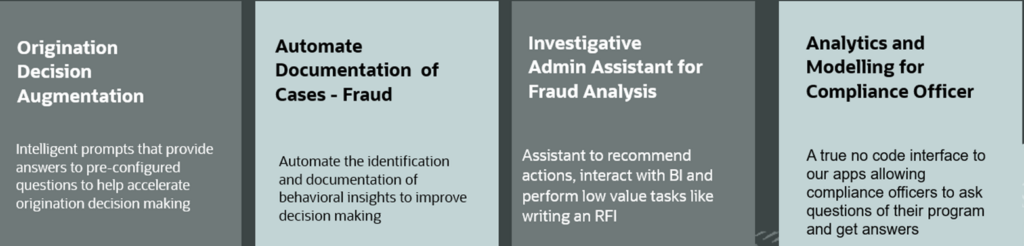

Oracle is on the frontlines of helping banks to transform corporate banking with innovative use of Generative AI. Capabilities include:

$200-340 billion estimated business derived from generative AI in banking. 77 per cent of bankers believe the ability to unlock the value of AI will be the difference between winning and losing banks. Economist Impact adds that forging new frontiers: advanced technologies will revolutionise banking.

Inspiring And Enabling Innovation Across Africa

Oracle is uniquely positioned to partner with banks in Africa as they embark on their digital transformation journey. With over 20 years of history here and 100+ banking customers, it is promising to see more banks streamline their business operations and enhance the customer experience using Oracle. We deliver:

- Africa-ready banking capabilities that have been tested and proven in production.

- Cloud availability in Africa—complete ownership from applications to cloud with our choice of deployment, including SaaS.

- End-to-end capabilities and solutions—front, middle- and back-office.

- Modern banking architecture—The right architecture for today’s cloud-first, componentised, and embedded finance world.