advertisement

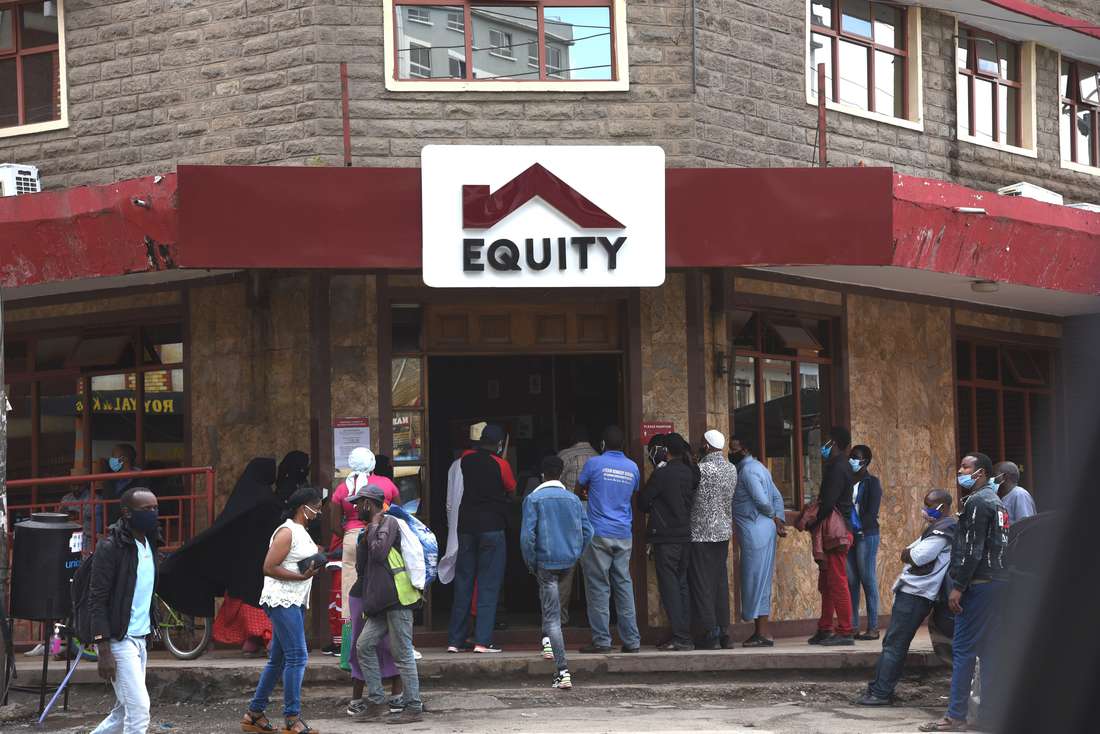

Equity Bank Launches Its Overdraft Loan Facility To Compete With Fuliza

Equity Bank Kenya has announced the launch of its overdraft loan facility dubbed ‘Boostika’ that will bring competition to Safaricom’s Fuliza.

The unsecured facility allows customers to overdraw their accounts up to Ksh 100,000 (USD 625) to complete transactions such as shopping. This will enable customers with insufficient funds when making a payment, sending money, or buying airtime, to complete such transactions and pay the amount within a month at a cost of credit of 8.5 percent.

According to the terms and conditions of the product, Boostika will only be available to customers with accounts that have been active for at least six months. The customers are allowed to draw multiple overdrafts for as long as the unpaid balance is within their limits.

advertisement

“The Boostika option is embedded on the transaction journey when one runs low on funds when making a payment, sending money or buying airtime, therefore offering one the convenience of completing a transaction seamlessly without exiting the payment journey,” says Equity in a statement.

A breakdown of charges shows Equity will charge five percent of the amount as a processing fee (also called loan application and credit evaluation fee), the interest of 1.5 percent per month, one percent as loan insurance and an excise duty of 20 percent of the processing fee.

Looking at Equity’s competition, the Fuliza overdraft charges give an effective interest of 2.3 percent per month, meaning customers using Equity’s will spend 3.7 times more on servicing the facility.

The overdraft is available for customers sending or making payments using Equitel, Equity Mobile App or the *247# option, promising to appeal to the many Equity customers on these platforms.

advertisement

“An individual’s limit is reviewed monthly to determine whether it should be increased or decreased based on the account behaviour, account transactions as well as the loan repayment history,” says Equity.

Equity Group data shows Equitel moved 27.5 million transactions valued at a cumulative Sh1.192 trillion (7.5 Billion USD) in nine months ended September last year while the Equity Mobile application had 161.6 million transactions worth Sh1.355 trillion (8.5 Billion USD).

The lender said the amount due for Boostika would be repaid through an auto-sweep from the borrower’s operative account, or a customer can decide to prepay or clear in full using the same three platforms they used for borrowing.

Although much limited in its reach, it’ll definitely be an alternative especially for small business people who are already Equity bank customers