advertisement

Digital Wallets To Account For A Quarter Of MEA E-Com Transaction Value By 2025

Digital wallets will see the largest payment method share gains in e-commerce transaction value in the Middle East and the Africa (MEA) region by 2025, a study by FIS, an American financial technology company forecasts.

“Representing 17.3 per cent of 2021 e-com spend in MEA, digital wallets are projected to account for 25.6 per cent of e-commerce transaction value by 2025. Led by PayPal and KongaPay, the use of digital wallets in Nigeria is projected to more than double from 7.6 per cent in 2021 to 15.5 per cent in 2025,” the 2022 Global Payments Report by Worldpay from FIS says.

Digital wallets comprised 48.6 per cent of global e-commerce transaction value globally in 2021, or just over US$2.6 trillion. The report says they are projected to rise to 52.5 per cent of transaction value in 2025.

advertisement

“Growth will be driven by digital wallets offering superior checkout solutions, flexibility in underlying payment methods, their anchor role in e-com marketplace ecosystems and local wallets consolidating into regional and global super apps”

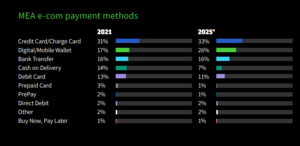

Notably, while the global e-commerce payment preferences continue to shift away from cash and credit cards towards digital wallets and buy now, pay later (BNPL) in other continents, credit cards remain the single largest e-com payment method across the MEA region.

“In e-commerce payment methods, MEA is seeing continued strength in market-leading credit cards, growth in digital wallets, bank transfer and BNPL, and declines in Cash On Delivery (COD). Credit cards remain the single largest e-com payment method across MEA accounting for 31.3 per cent of 2021 transaction value; they are projected to represent one-third of e-com spend by 2025,” the report says.

advertisement

Accounting for 21 per cent in 2021, credit’s share of global e-com spend is projected to fall to 18.8 per cent in 2025, though absolute value will rise to over $1.56 trillion. Debit is projected to fall less dramatically, from 13.2 per cent of e-com transaction value in 2021 to 12.9 per cent in 2025, with absolute value rising to over US$1.07 trillion.

Going by the report, traditional banks are set to continue facing tough competition from non-banking players given the projected growth of digital wallets. They need to come up with similar innovative payment methods or risk losing their customers to new players.