advertisement

Cytonn banking report: Mobile, internet helping Kenya’s banking sector to grow

The Cytonn Banking Report has revealed that the banking sector in Kenya experienced growth in Q1’2016, in assets, deposits, profitability…

The Cytonn Banking Report has revealed that the banking sector in Kenya experienced growth in Q1’2016, in assets, deposits, profitability and products offering. This was supported by increased use of alternative channels of distribution and the favourable macroeconomic environment.

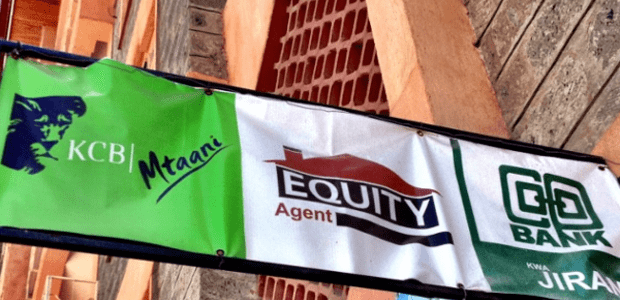

“The growth in Kenya’s banking sector can be attributed to increased use of alternative channels of distribution such agency, mobile and internet banking in deposit mobilisation and loan disbursement, branch network expansion strategy both in Kenya and in the region and the banks’ response to the needs of the Kenyan market of convenience and efficiency in financial services delivery through channels such as mobile, internet and agency banking,” said Maurice Oduor, Investment Manager. “Most banks operating in the region were impacted with KCB and Equity bank being worst hit by the devaluation of the South Sudan’s currency.”

KCB Group emerged top in Q1’2016 Cytonn Banking Report, supported by a strong franchise and intrinsic value score while National Bank was ranked the lowest, ranking lowest in both franchise and intrinsic value score.

advertisement

“The report themed ‘Transition continues, to a new and different landscape’ analyzed all listed banks in the Kenyan market so as to recommend to investors which banks are the most stable from a franchise value and future growth opportunity perspective,” said Elizabeth Nkukuu, Cytonn’s Chief Investment Officer. “The analysis covers the health and future performance of the financial institution, by highlighting their performance using metrics that measure profitability, efficiency, growth, asset quality, liquidity, revenue diversification, capitalization and intrinsic valuation. The overall ranking was based on a weighted average ranking of Franchise value (accounting for 40%) and Intrinsic value (accounting for 60%),” added Elizabeth.

Equity Group emerged second, followed by Co-operative Bank of Kenya, with Barclays Bank of Kenya emerging fourth, and I&M Bank ranked fifth. Diamond Trust Bank declined three positions to position 6, mainly as a result of a drop in franchise ranking due to lower Return on Equity of 16.0%, compared to the industry average of 18.6%. It also ranked poorly in revenue diversification with Non Interest Income to Total Revenue of 20.5%, against an industry average of 28.7%. CfC Stanbic declined three positions to position 9, affected by both poor franchise and total return score. The low franchise score was due to a low Net Interest Margin of 5.3% against an industry average of 8.3%.

The listed banks aggregate gross loans and advances grew by 14.6% to Kshs. 1.7 trillion in March 2016 from Kshs. 1.5 trillion in March 2015 while deposits grew by 11.5% to Kshs. 2.0 trillion in March 2016 from Kshs 1.8 trillion in March 2015. Total assets grew by 10.5% in March 2016 to Kshs 2.8 trillion, from Kshs 2.5 trillion in March 2015. Since 2010, deposits have grown at a CAGR of 15.1%, with loans and advances having grown faster than deposit at a CAGR of 18.7%. For Q1’2016, listed banks recorded a core earnings growth of 13.5% compared to 8.6% in Q1’2015 as a result of improved economic conditions in the country.

advertisement

The sector continues to be in transition in the following core areas;

A more disciplined sector led by a disciplined regulator, through the Central Bank’s Governor, who has already indicated that the level of supervision and regulatory oversight needs to increase,

Deposits flight to quality post the closure of Chase and Imperial Bank, which will cause liquidity pressures to be solved either through consolidation or increased capital raising,

advertisement

More capital raising exercise as shown by Family Bank and KCB Group rights issue, as banks look to shore up their capital,

Consolidation as shown by Oriental Commercial Bank’s purchase by Bank M of Tanzania, and

Corporate governance coming to the forefront.

At the end of this transition, we are going to have fewer, but stronger, more transparent and well-governed banking sector players.