advertisement

New mergers over electricity targeting Africa

Denham Capital and GreenWish Partners recently announced a partnership to develop, build and finance a portfolio of 600 megawatts (MW)…

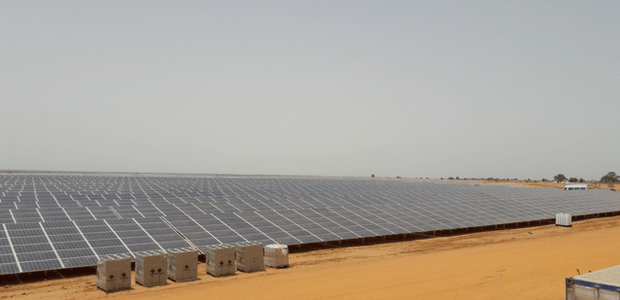

Denham Capital and GreenWish Partners recently announced a partnership to develop, build and finance a portfolio of 600 megawatts (MW) of renewable energy assets across sub-Saharan Africa by 2020. The capital commitment will allow the African renewables platform to carry out a USD$1 billion project pipeline.

In another case Harith General Partners (Harith) and Africa Finance Corporation (AFC) have merged their power sector assets, expertise and experience to create a new energy entity combining both renewable and non-renewable power generating assets in Africa.

More than 600 million people in sub-Saharan Africa do not have access to electricity, according to the International Energy Agency. These partnerships will thus allow for power generation and the integrated management of power infrastructure assets to deliver the requisite base load generation capacity to drive and accelerate growth in African economies.

advertisement

Charlotte Aubin-Kalaidjian, CEO of GreenWish, said, “We look forward to partnering with Denham for this expansion phase of GreenWish in sub-Saharan Africa. Independent power producers such as GreenWish are a key solution to the African electricity gap that requires more than $40 billion in annual investments. Our strategic partnership with Denham gives us the means and scale to carry out our ambition and mission for a competitive and sustainable electrification of Africa.”

Total African power generation capacity is limited to 90 GW while the continent enjoys on average 300 sunny days per year. Solar energy is a solution to Africa’s electricity shortage that is both competitive and clean with a short time to market. Excluding South Africa, average annual consumption is around 162 kWh per capita, a fraction of the global average of 7,000 kWh. Energy-sector bottlenecks and power shortages cost the region 2-4 percent of GDP annually, undermining sustainable economic growth, jobs and investment.

“We focus on countries where renewable energy projects offer a competitive solution to the power gap, without subsidies,” explained Parmentier, Chief Investment Officer at GreenWish. “GreenWish is looking at both on and off-grid projects in a number of countries and aims at offering B2B solar hybrid solutions to energy intensive industries, including telecom operators, mining and commercial off-takers.”

advertisement

In the case of Harith and AFC, their joint venture will merge AFC’s interests in Cenpower, owner of the Kpone Independent Power Project under construction in Ghana, and Cabeolica, a wind farm that provides 20% of Cape Verde’s energy needs, with those of the Pan Africa Infrastructure Development Fund (PAIDF) which is managed by Harith. These include the Azura Edo IPP in Nigeria, the Lake Turkana Wind Power in Kenya, Kelvin Power Station in South Africa and the Rabai Thermal project in Kenya. Collectively this portfolio represents some of the largest projects in Africa’s energy sector.

The new venture will be in a position to develop and finance projects through corporate finance transactions and project finance, significantly reducing the lead time to bringing power projects to fruition. It will also have the benefit of a team of dedicated advisers that bring a wealth of development and operational experience in the African power sector.

Andrew Alli, President and CEO of AFC, commented on the launch: “We are delighted to be announcing this partnership with Harith. Our new joint venture will make an invaluable contribution to improving generation capacity in countries across the length and breadth of Africa and by working together we can deliver tangible benefit for Africans, switching their lights on and stimulating positive economic growth on the continent.

advertisement

Tshepo Mahloele, CEO of Harith and Chairman of Aldwych, said: “The purpose of the proposed merger is to combine the assets of Aldwych and AFC so as to create an African power entity that will have substantial capital, sector specific experience, a critical mass of existing assets and a pipeline of credible power projects.