advertisement

#Mobile360Africa: Africa’s mobile growth set to slow from a previous CAGR of 11% to a rate of 6%

Africa’s mobile growth is set to slow from a previous Compound Annual Growth Rate (CAGR) of 11 per cent between…

Africa’s mobile growth is set to slow from a previous Compound Annual Growth Rate (CAGR) of 11 per cent between 2010 – 2015 to a rate of 6 percent between 2015-2020, reflecting a global downward trend.

This is according to a new report by GSMA The Mobile Economy Africa 2016 launched at GSMA Mobile 360-Africa in Dar es Salaam,Tanzania.

According to GSMA director general Mats Granryd there are significant barriers to connecting unconnected populations in the region, including limited network coverage, high cost of mobile ownership, a lack of locally relevant content and a lack of digital skills and this could be the reason why there could be a slower growth in mobile adoption.

advertisement

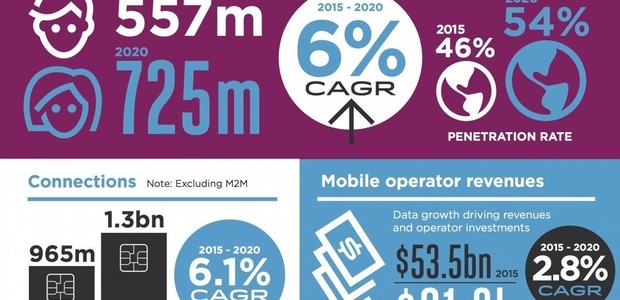

By the end of 2015, there were 557 million unique subscribers in Africa, accounting for 965 million connections. Africa is the second largest region behind Asia Pacific in terms of unique subscribers (12% of the global subscriber base) but is also the least penetrated. At the end of 2015, less than half of the population subscribed to mobile services, well below the global average of 63%, and lower than that of the Middle East (58%), Asia Pacific (62%) and Latin America (65%).

Growth has been rapid up to this point: subscriber numbers have grown at an average annual rate of 11% over the last five years, the fastest growth rate globally. However, in 2015, subscriber growth was less than 9% and will increasingly converge with the global average over the next few years: average annual growth between 2015 and 2020 will be 6% compared to a global average of 4%. This will nevertheless be the fastest growth rate of any region.

The report further states that over the next five years, an additional 168 million people will be connected by mobile services across Africa, reaching 725 million unique subscribers by 2020. Eight markets will account for the majority of this growth, most notably Nigeria, Ethiopia and Tanzania, which will together contribute more than a third of new subscribers.