advertisement

M-KOPA Raises $250m In Funding – Kenya’s Highest Yet

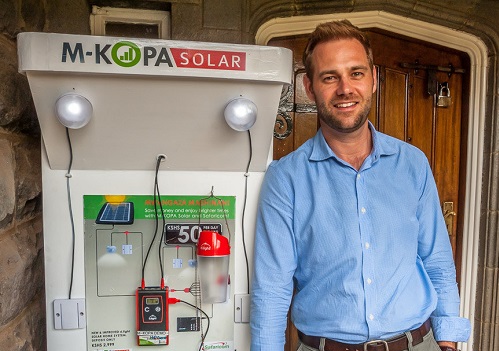

The solar and asset-financing start-up, M-KOPA, which offers underbanked African customers access to ‘productive assets’ and the ability to pay for them via digital micropayments, has secured over $250 million in funding.

The capital injection includes $55 million in equity and over $200 million in debt, huge sums in both categories that testify to strong fundamentals and solid performance for any growth-stage company in this venture capital’s current contraction. Following the $75 million in equity the Kenyan-based fintech announced last March, M-KOPA has raised $245 million in equity funding since its inception in 2011.

“As we continue to scale we remain committed to building a sustainable business and closing economic and digital gender gaps. We are delighted to have the support of new and existing investors who share our vision and mission,” M-KOPA Solar CEO and Co-Founder Jesse Moore said.

advertisement

The funding round was led by Standard Bank which advanced $200 million in sustainability-linked debt financing, while Sumitomo had injected $36.5 million in new equity investment. Other participants in the fund-raising included UK-based investment firm Lightrock, M-KOPA said.

Underbanked customers in emerging markets face challenges due to low-income, limited credit histories, and lack of collateral. Strong identity and credit scoring infrastructure in developed markets enables various credit options, allowing individuals to make large purchases through post-paid methods. However, in sub-Saharan Africa, where 85 per cent of the population lives on less than $5.50 per day, making major purchases without credit is difficult, while access to credit remains limited. In these markets, individuals have limited pre-existing financial identities and conventional collateral.

M-KOPA’s business revolves around using debt to finance customers’ purchase of products and services it sells, such as smartphones and solar power systems, as well as loans and health insurance across four markets: Kenya, Uganda, Ghana and Nigeria. With its flexible credit model, the business allows individuals to pay a small deposit for the two products above and pay off through micro-instalments, helping build their credit history over time. Default rates are a little above 10 per cent.

advertisement

So far, M-KOPA has received over $100 million in working capital financing for this repayment cycle. It has doubled that amount with this new financing. Standard Bank, Africa’s largest bank in terms of assets, provided half of the $200 million+ “sustainability-linked” debt financing. Development financial institutions: the IFC, FMO, and BII and funds managed by Lion’s Head Global Partners, Mirova SunFunder, and Nithio topped up the rest.