advertisement

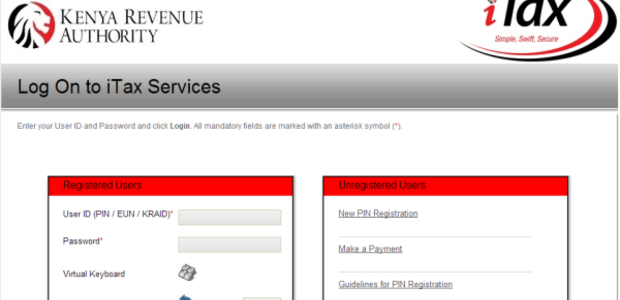

KRA makes changes to iTax system

Kenya Revenue Authority has introduced a raft of new changes to the iTax system aimed at encouraging use of online…

Kenya Revenue Authority has introduced a raft of new changes to the iTax system aimed at encouraging use of online for the tax filing aimed at boosting tax compliance and revenue collection.

Among the key changes include introducing a single number for tax payers transacting online. Tax payers will now be required to use only their PIN number when submitting returns for PAYE, Excise and VAT.

Speaking during the launch the iTax media campaign, KRA Commissioner General, John Njiraini said the Authority is leveraging on technology to increase tax compliance.

advertisement

“The goal of the Authority is to simplify the process to ensure more Kenyans’ are tax compliant. The iTax has enabled KRA to better understand taxpayer behavior, which is critical in designing and implementing effective compliance strategies that contribute to the sustainability of our taxation systems,” said Njiraini.

Njiraini said with the introduction of iTax system, taxpayers are able to authenticate information such as Personal Identification Number (PIN) or Tax Compliance Certificate (TCC) hence distinguishing fake information from what is genuine.

“There is a growing trends among corporate firms to trade with only tax complaint organizations. Having a tax complaint certificate today gives firms a competitive edge when competing for tenders to supply various goods and services,” said Njiraini.

advertisement

He said iTax has drastically reduced VAT and PAYE returns filing period to within 67 and 72 minutes respectively.

iTax system is capable of providing instant feedback as an acknowledgement to transactions triggered by taxpayers.

Taxpayers are now able to file for refunds online thus saving them the burden of making copies of manual documents to be submitted.

advertisement

The Authority has also set up a comprehensive support network across the country. Currently the support is available at 14 Huduma Centres and five support centers and an additional 21 Huduma centres will be operational by May 2015.

Mr. Njiraini said the iTax system will lower corruption and bureaucracy by reducing face-to face interactions.

“KRA goal is to minimize taxpayer direct interaction with tax officials to ensure less discretion in deciding how to treat them. Through iTax, there’s a promotion of equity, communication with taxpayers, preventive impact on corruption and bribery, and impediment on tax avoidance and tax evasion,” Njiraini concluded.