advertisement

Global blockchain spending to hit $12.4B by 2022; finance sector leads growth

The largest chunk of worldwide spending on new blockchain networks – nearly $2.9 billion this year – will come from…

The largest chunk of worldwide spending on new blockchain networks – nearly $2.9 billion this year – will come from the financial sector, where banking, securities and investment services, and insurance industries will invest more than US$1.1 billion, according to a new IDC report.

The research firm also noted that blockchain implementations are moving quickly beyond the pilot and proof-of-concept phase to real-world production systems.

“The use cases that comprise the blockchain opportunity are developing as swiftly as the technologies enabling it,” said Jessica Goepfert, IDC’s program vice president for customer insights and analysis. “While spending for more developed use cases in the financial sector like trade finance and cross-border payments is still healthy and growing strong, relative to six months ago we’ve seen an acceleration in spending across a variety of other areas, such as energy settlements and warranty claims.”

advertisement

For example, last fall, Walmart and Sam’s Club, both of whom were piloting a supply chain management system based on blockchain, told their produce suppliers to get on board the distributed ledger network within a year so they can track vegetables from farm to shelf. That deadline: September 2019.

And J.P. Morgan Chase recently announced it plans to launch what is considered to be the first cryptocurrency backed by a major bank, a move that could legitimize blockchain as a vehicle for fiat cryptocurrencies.

J.P. Morgan’s JPM Coin will basically be a way of using a permissioned blockchain ledger to keep track of balance transfers within the bank’s business, and internationally between institutional clients.

advertisement

IDC

IDCIn all, blockchain spending this year is expected to increase of 88.7% from the $1.5 billion spent in 2018, according to IDC’s updated Worldwide Semiannual Blockchain Spending Guide.

IDC expects blockchain spending will grow quickly through 2022 with a compound annual growth rate of 76%; total spending is set to reach $12.4 billion in 2022. The U.S. will spend more on the technology than any other world region ($1.1 billion), followed by Western Europe ($674 million) and China ($319 million). Of the remaining regions, Japan and Canada will lead the pack with a five-year annual growth rate of of 110% and 90%, respectively.

Last July, IDC had predicted global blockchain spending would hit $9.7 billion in 2021 and $11.7 billion in 2022.

advertisement

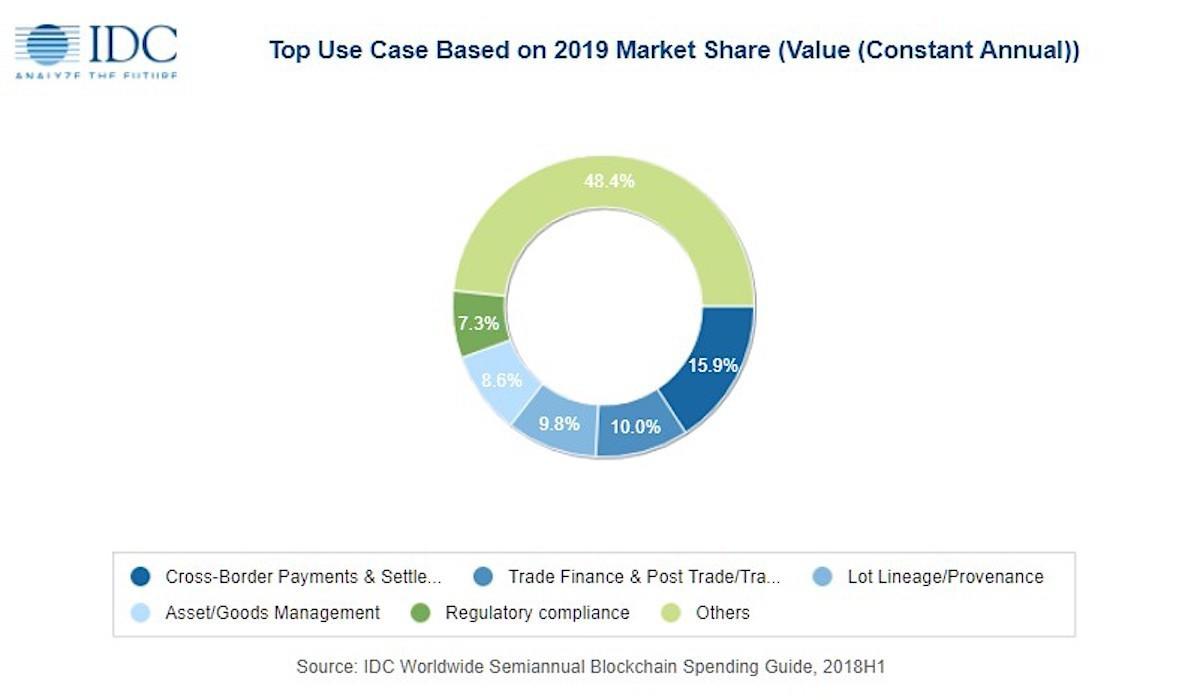

Led by the financial sector this year, blockchain will mainly be used to enable cross-border payments and settlements ($453 million) as well as trade finance and post-trade transaction settlements ($285 million).

From a technology perspective, IT services and business services (combined) will account for nearly 70% of all blockchain spending in 2019.

Blockchain investments by the manufacturing community will mainly be in tracking parts provenance and goods management, while identity management will see significant investments from the banking, government and healthcare provider industries.

Last month, a survey by KPMG of C-level leaders at technology companies showed most believe blockchain will change the way their firms do business – and more than 40% plan to roll out blockchain during the next three years.

Breakthroughs last year, including regulators recognizing their governance role and more mainstream acceptance of the distributed ledger technology, is leading companies to move from pilots and proofs of concept to production systems, according to said Stacey Soohoo, IDC’s research manager for customer insights and analysis.

“In many use cases, incorporating blockchain into the mix has been better than the status quo,” Soohoo said in a statement. “With enterprises trying to find a balance between decentralizing their business processes while bringing common standards to the blockchain space, the future state of the blockchain world relies on collaboration and building bridges between organizations and communities.”