advertisement

Does Orange Intend To Start A Price War With Safaricom?

Orange has perhaps been the most silent player in the telecommunication market in terms of picking up wars with rivals…

Orange has perhaps been the most silent player in the telecommunication market in terms of picking up wars with rivals with all the other players having taken on to each other’s throats in the past years. That’s why the latest round of advertising by the French-owned telco that directly hit at market leader Safaricom has surprised many.

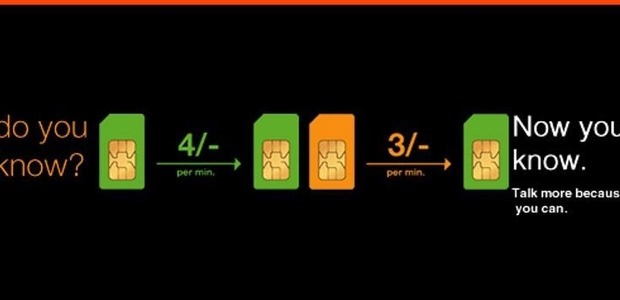

In the veiled attack, Orange uses SIM card which are green and orange in colour to differentiate the two operators and shows that it costs less to call Safaricom from its network than an on-net call within Safaricom.

The advert shows that Safaricom’s call rate on-net and off-net is Kshs 4 as compared to the 25 per cent cheaper Tujuane tariff with an off-net rate to (Safaricom) of just Kshs 3.

What stands out is the timing of the Orange onslaught on its rival, Safaricom. Safaricom is currently facing a row with the government – that is the ministry of information and the industry regulator Communications Commission of Kenya – over the just-released quality of service report.

advertisement

Just yesterday, the information cabinet secretary Dr Fred Matiang’i warned telecoms operators that their license renewals will be pegged on the provision of services in an attack directed at Safaricom which requires a new license in June 2014.

Although no operator was said to have complied with the set standards, Orange was best ranked at 62 percent compliance as compared to the other competitors who had a score of 50 percent, a huge morale booster for the Mikhail Ghossein-led telco. The report, many will say, has acted as a marketing tool for Orange with an excellent rating of 100 percent score in Nairobi.

The main question however that lingers over many analysts’ mind is how deep the operator’s pockets are and how far Orange is willing to push this feud. Another question is whether Safaricom will respond or give a deaf ear to the scathing attack.

advertisement

In my public relations class in university, my lecturer clearly differentiated advertising from propaganda and clearly spelt out the repercussions of each the company carrying out a particular campaign.

In any competition, there might not be an outright winner but there is surely a loser.

The most outright way Orange can carry the day is by acquiring some of Safaricom’s 20 million clients who could be lured to join the network due to the cheap rates.

advertisement

However, the attack could also re-direct customers’ focus towards other operators’ services and tariffs who provide the same services as Orange but might have created a better reputation in mobile telephony.

This is considering that Orange is coming from the dark years of landline telephony when its quality of services left a bitter taste in many consumers’ mouths.

To Safaricom, the scenario could also go two ways, including a loss of customers and thus revenue and a consolidation. For anyone who has been in this market long enough knows that the green operator is a fox.

Safaricom could chose to cushion itself against the attack by simply lowering call charges or could decide to fight back.

In both ways, Safaricom could feel the pinch of Orange’s direct confrontation.

Without debate, a reduction in calling charges will have an effect on the company’s profits considering that the tariffs went up after the most profitable company in Kenya had a drop in profits causing acrimony from investors.

Taking the battle to Orange could also seem unwise as the response could attract the other operators into the war that they have failed to win when they started it.

Whatever effect the attack could take should Safaricom brush it aside is also debatable.

All in all many will say the timeliness of the adverts will surely have an effect at Safaricom’s reputation.

Without doubt the time is ripe for Orange’s under the table shot but how the future shapes up is totally in the hands of Safaricom.